Pricing is the second P of seven in the marketing mix:

- Product

- Price

- Place

- Promotion

- Packaging

- Positioning

- People

A pricing strategy is something that far too many companies implement without giving it any serious consideration. This lack of consideration is a mistake and can cause them to lose money.

The good news is that correctly setting your product price may be a tremendous growth lever when done correctly. Your revenue will increase dramatically if you adjust your pricing strategy so that more customers are willing to pay a higher price.

This article will cover everything you need to know about setting a pricing strategy that works for your business.

Pricing Definition

Pricing is a term used to describe the decision-making process before you value a product or service.

Your price must communicate how much you care about your brand, product, and customers to your potential consumers. It’s one of the first things a consumer considers when deciding whether or not to acquire your goods or service. That’s why a precise estimate is needed.

Pricing Strategy Definition

Pricing strategies are the methods and procedures companies employ to determine the rates they charge for their goods and services. Pricing is the amount you charge for your items; pricing strategy is how you calculate that number.

Pricing strategy can encompass anything from:

- The state of the market

- Competitors actions

- Account segments

- Profit margins

- Input costs

- The financial capability of the average consumer

- Amounts spent on manufacturing and distributing products

- Variable costs

What Is The Importance Of Pricing?

A successful pricing strategy helps you strengthen your position in the market by earning your clients’ confidence and bringing your company closer to achieving its objectives.

Pricing strategies can be important for various reasons, but those reasons might differ from company to company.

Pricing strategies aren’t necessarily about profit margins, despite common opinion. For example, you can want to keep the price of an item or service low to keep your share of the market and keep competitors out.

We look at 11 common pricing strategies in detail below:

Having a good pricing strategy can be the difference between success and failure in the market. But there’s no need to fret, we’ve gathered 11 of the best pricing strategies so that you can choose what fits your business needs.

1. Cost-Plus Pricing Strategy

One way to price a product is to add a fixed percentage to the manufacturing costs for each unit. This pricing technique is known as “cost plus” or “markup pricing.”

As a seller, you would calculate the fixed and variable expenses incurred in making your goods and then apply the markup percentage to that cost. This approach is popular since it’s simple to defend and almost always results in a level playing field for all participants.

2. Competitor-Based Pricing Strategy

Competitive pricing is the practice of setting your product or service prices based on the pricing of your competitors in your market or niche rather than on your company’s costs or desired profit margins. Sometimes this means just raising your prices, but you also can offer better terms of payment as an alternative.

3. Value-Based Pricing Strategy

The method of determining your rates, known as value pricing, considers how much your customers value what you provide and adjusts your prices accordingly. You must employ a marketing mix to retain sales and deliver more value to your clients in the face of increased competition or a recession.

Due to the perceived worth of the product or service, buyers flock to this price strategy over the competition. Customers don’t care how much it costs a corporation to manufacture a product; what matters is that the client believes they are getting a good deal when they buy it.

4. Loss Leader Pricing Strategy

Loss leader pricing is a marketing strategy where one or more retail goods are chosen and sold below cost – at a loss to the retailer – to entice customers. Loss leads are items offered at deeply discounted rates to draw customers into the business.

5. Penetration Pricing Strategy

The penetration pricing strategy aims to draw customers by providing products and services at lower costs than rivals. This tactic can take attention away from competing firms and lead to long-term contracts by promoting brand recognition and loyalty. However, in the long run, brand recognition may lead to higher earnings and help small businesses stand out from the crowd.

6. Everyday Low Pricing Strategy

Retailers use “everyday low pricing” to maintain perpetually low prices for their items rather than special promotions or sales.

As a result, the daily low pricing strategy aims to optimize sales by always giving the lowest prices on the market and anticipating huge sales volumes.

7. Economy Pricing Strategy

Economy pricing aims to get the most price-conscious customers to purchase the product. Because they don’t have to pay for additional promotion or marketing expenditures, businesses may price their products according to their manufacturing value.

8. Premium Pricing Strategy

Businesses that charge premium prices do so because they have a specific product or brand that no one else can match. Suppose you have a significant competitive edge and know you can charge a higher price without being undercut by a product of comparable quality. In that case, you should consider using this technique.

9. Skimming Pricing Strategy

Price skimming is a dynamic pricing strategy businesses use to increase sales of new goods and services.

Price skimming is a strategy usually employed at a new product’s debut. This strategy aims to maximize income to the greatest extent possible when customer interest in the product is strong, and your company faces low competition.

10. High-Low Pricing Strategy

High-low pricing is a strategy where a business focuses on marketing campaigns to entice customers to make purchases. For example, a company charges a high price for a product and then lowers the cost through promotions, markdowns, or clearance sales. A product’s pricing fluctuates between “high” and “low” in a certain amount of time with this method.

11. Dynamic Pricing Strategy

Dynamic pricing involves charging variable costs depending on who or when you purchase your goods or service. Flexibility in pricing is one of this technique’s essential features, which considers supply and demand.

While dynamic pricing is widespread in e-commerce and transportation, it isn’t appropriate for all businesses. The greatest dangers lay in implementing variable prices with price-sensitive products and services.

1. Cost-Plus Pricing Strategy Example

In “cost-plus pricing,” businesses can charge a higher price for their goods or services than they pay to create or deliver them. Profit margins can vary from company to company based on production cost.

For example, a company that sells sunglasses and wants to use the cost-plus approach to price their product may come up with the following:

Expenses incurred in the manufacture of goods: To get to a total production cost of $357.00, the corporation adds its $220.10 in material expenses, $56.15 in labor costs, and $80.75 in allocated overhead.

The price per unit: The next step is to divide the total cost of manufacturing by the amount of product produced. They made 20 pairs of sunglasses in this case. $357.00 divided by 20 equals $17.85.

The expense of selling: Using a 30% markup, the sunglasses company may multiply the unit price by 1 x.30 to come up with $23.21. Based on this figure, a pair of sunglasses will set you back $23.50.

Thus, $23.50 is the amount of a pair of sunglasses after implementing the cost-plus pricing strategy.

2. Competitor-Based Pricing Strategy Example

In competitive pricing, a product’s price is established by its competitors’ prices. Amazon’s price of popular items serves as a real-world illustration. The retail behemoth gathers competitive pricing knowledge and uses it to provide the lowest price on the market at any given moment.

Before making a purchase, most people use the internet to compare prices. As a result, internet retailers keep tabs on each other’s prices to stay on top of the market.

However, not everyone wants to be known as the most affordable.

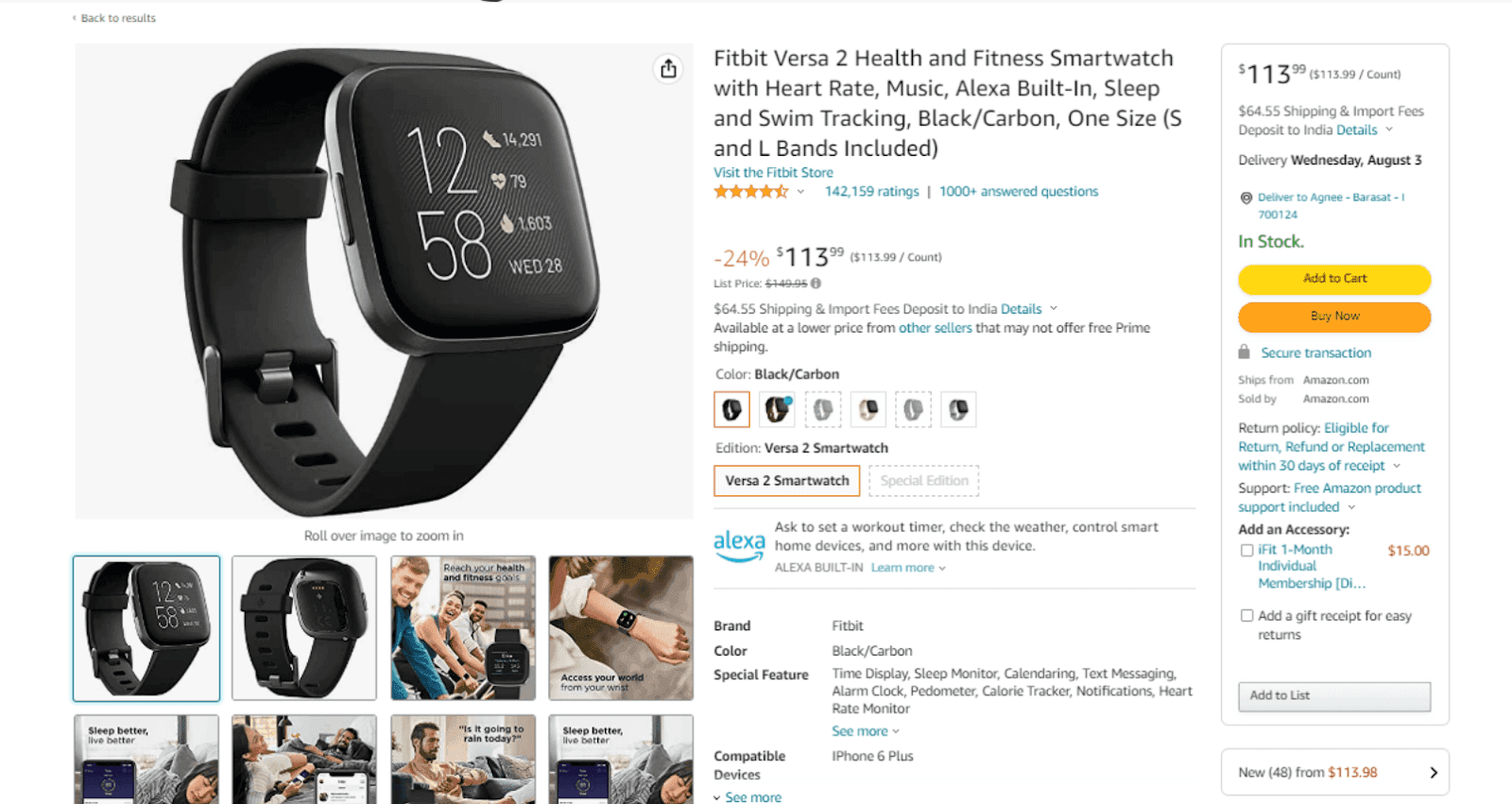

Take a look at the Fitbit.

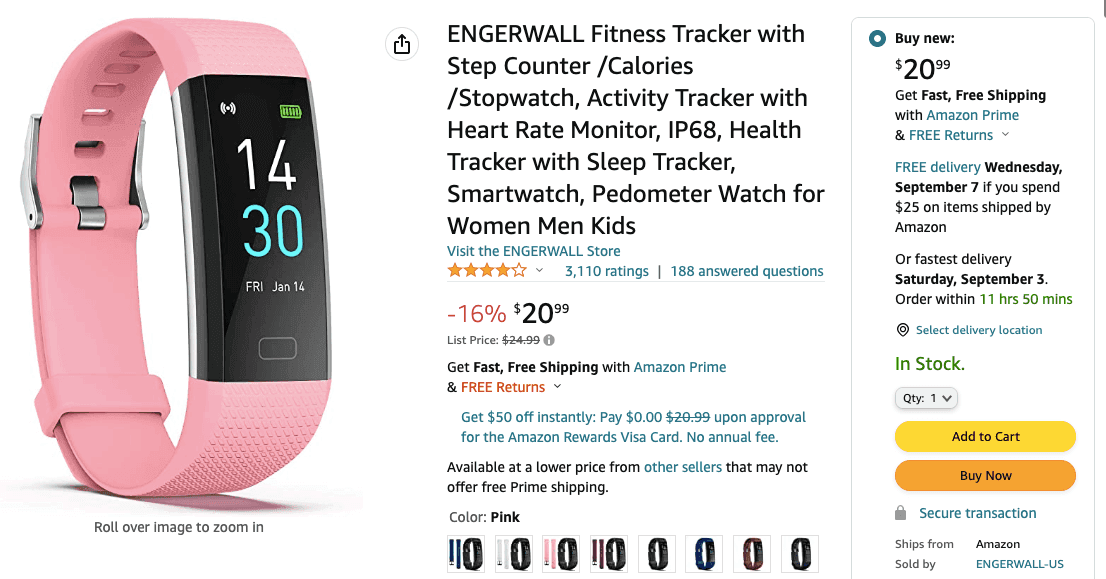

Next, look at a similar business that offers wearable tech and is also available on Amazon.

Fitbit, being a well-known brand, can demand a higher price in this instance. Consumers are ready to spend far more for a famous brand than they would for a lesser-known one.

3. Value-Based Pricing Strategy Example

Value-based pricing is a pricing strategy based on how valuable a consumer believes the product or service is.

When it comes to pricing, Apple’s strategy revolves around the customer. In this case, the brand name is more important than the product itself.

Initially, their pricing mirrored the simplicity of their products and the ease with which customers could use them. Over the years, this was an exercise in gaining market share and establishing a devoted consumer base.

To do this, they created an operating system that was easy to use, putting it ahead of the competition. Apple goods now account for most personal computers, cellphones, smartwatches, MP3 players, and other electronic devices in the United States.

Essentially, Apple has given up market research to build and retain brand loyalty, and its revenues have reflected this shift in strategy.

4. Loss Leader Pricing Strategy Example

Using a pricing strategy known as “loss leader pricing,” a company tries to entice new consumers by offering items at a discount below what it costs to make them.

Microsoft released their Xbox gaming console with a relatively low-profit margin to compete with Sony Playstation’s established players. This strategy compelled customers to buy the console since it was so inexpensively accessible.

However, this was not the end of the story, as the console was pointless without any games to play.

Microsoft used its pricing strategy to compensate for the losses it incurred when selling consoles by raising the prices of its games.

5. Penetration Pricing Strategy Example

Businesses use penetration pricing is a pricing strategy that lures customers into trying out a new product or service by first providing it at a cheaper cost.

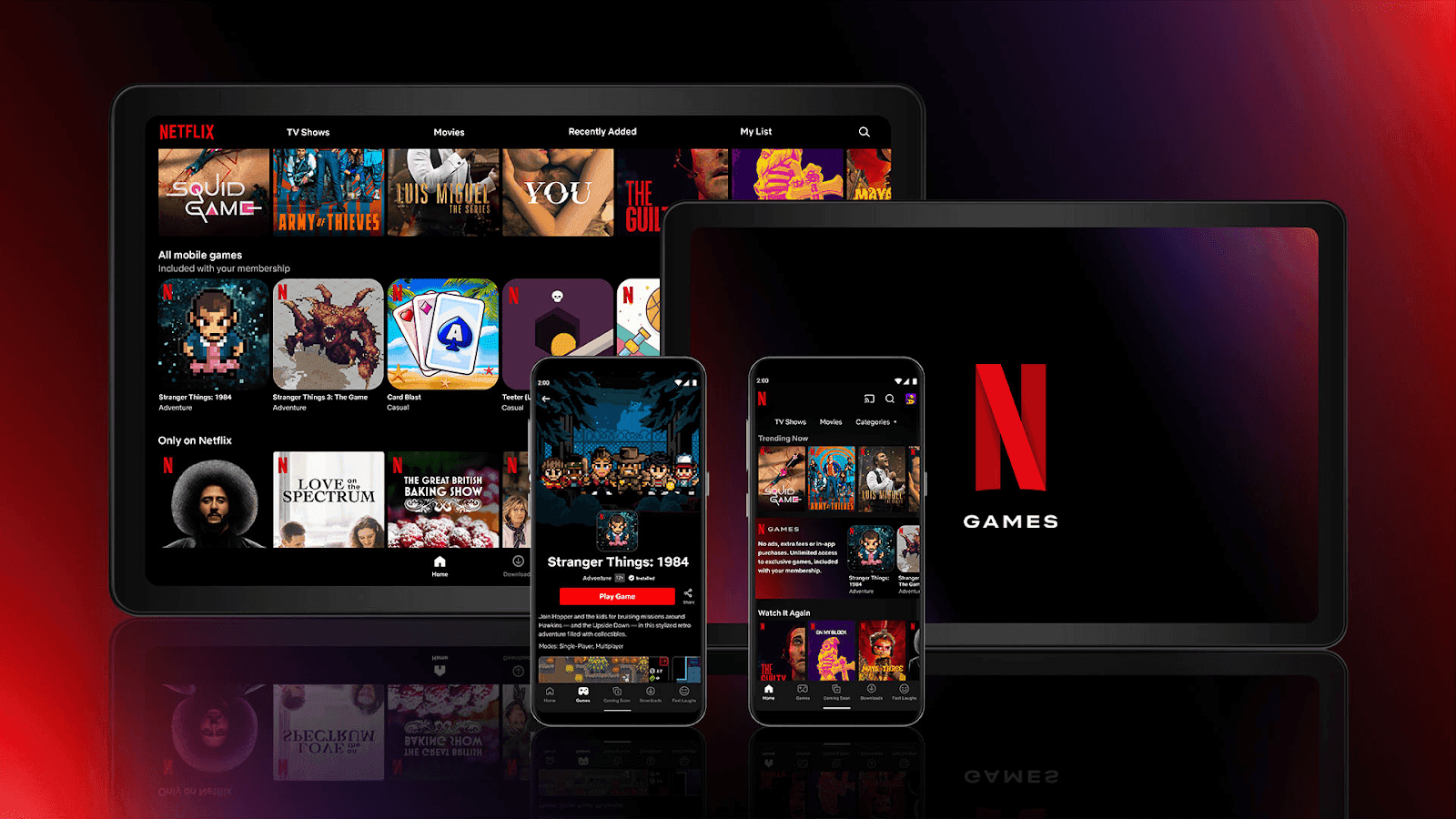

Regarding penetration price, Netflix is a textbook case in point. Many customers have expressed dissatisfaction with Netflix due to rising membership costs or the expiration of their free trial period.

Nevertheless, despite the occasional complaints, people are satisfied with paying the increased membership fees in exchange for the never-ending supply of high-quality media content.

The first quarter of 2022 saw Netflix reach a global audience of around 221.64 million paying customers. Other OTT platforms are using penetration pricing to recruit new consumers, like Netflix.

6. Everyday Low Pricing Strategy Example

Everyday low pricing strategy allows firms, brands, and retailers to provide continuously low-priced items.

As a result of its everyday low-price approach, Walmart Inc. has become a significant player in the retail industry. Instead of giving low prices only during sales, the giant store gives inexpensive pricing to customers all year round.

Following its inception, the company pursued this strategy and established itself as the retailer that consistently provides customers with the lowest costs. Despite the low-profit margins, the shop will profit because of the large amount of merchandise it sells.

This pricing approach helped Walmart establish itself as a well-known, low-priced corporation. Walmart has over 10,500 stores and clubs in 24 countries under 46 banners.

7. Economy Pricing Strategy Example

A pricing strategy such as the “economy pricing” approach relies on reduced item prices due to decreased production costs.

Up & Up diapers, a 124-count pack, retail for $15.99 at Target under the Target brand name. A 104-count package of Pampers costs $27.49. Using fewer diapers saves you more than $11.

The Up & Up diapers represent Target’s economy pricing. Target doesn’t need to account for this production expense because it doesn’t market its diapers. Up and Up is less expensive than Pampers, which might influence customers’ purchase decisions when they visit the store.

8. Premium Pricing Strategy Example

Premium pricing is a technique that involves pricing your goods more than your direct competitors. The marketing strategy of the 7 Ps develops a successful marketing strategy that appeals to your target audience.

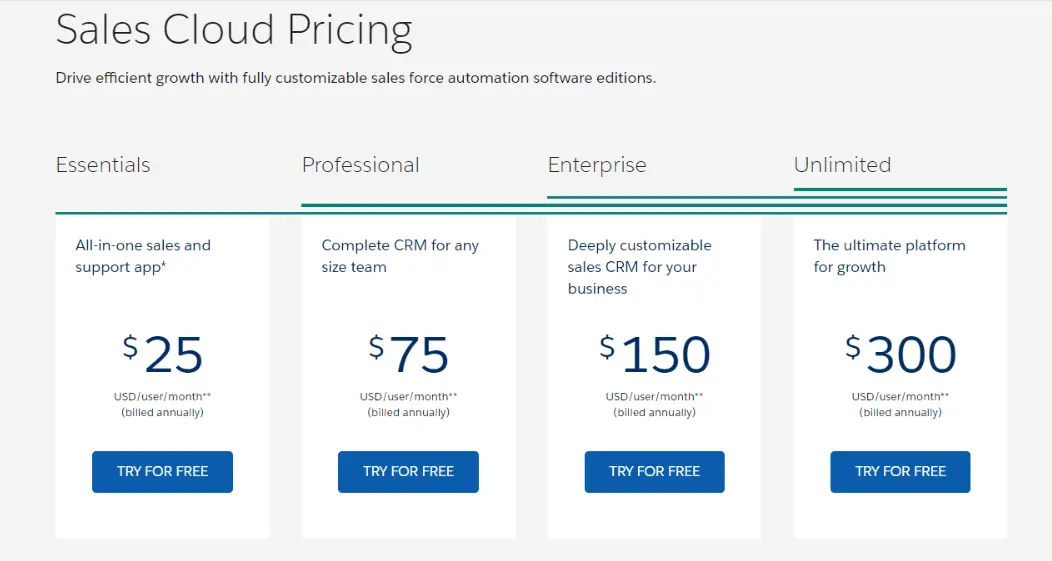

Salesforce has a great heritage with premium pricing because it is one of the few SaaS companies that has effectively implemented price skimming into its overall strategy. Here is a peek at the price information.

There is little denying that Salesforce’s “Unlimited” subscription is a premium choice. Prospects can tell the difference between this more expensive choice and the “Essentials” plan, which has a similar name but a far lower price tag.

It’s a smart move by Salesforce to provide a free trial for all plans, even the premium ones. In addition to free trials, premium pricing also benefits from creating brand equity through free trials.

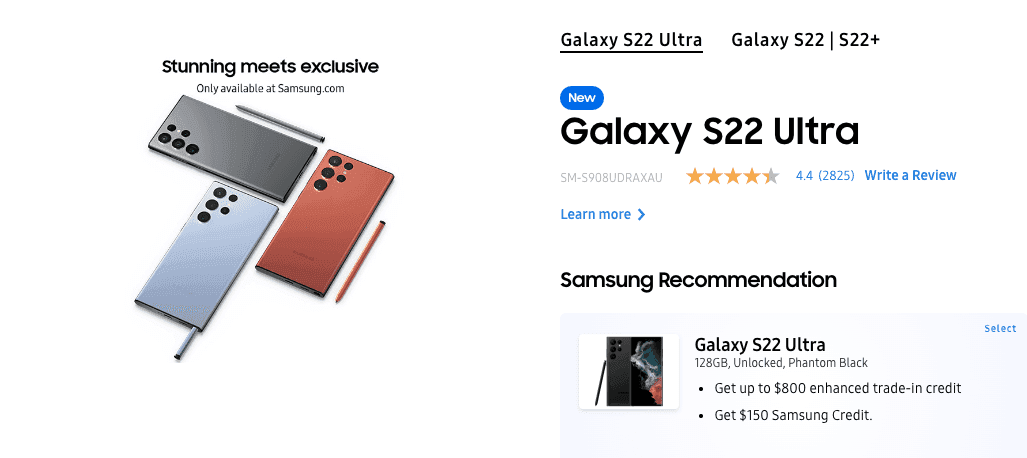

9. Skimming Pricing Strategy Example

Price skimming is a pricing strategy in which businesses initially charge a high price for their product or service while gradually lowering the price to attract a more price-sensitive market segment.

Price skimming can apply to a wide range of well-known items. Many electronic goods employ a price-skimming technique during the early stages of a product’s lifecycle. The device’s price then reduces once competitors develop rival goods, such as the Samsung Galaxy, to maintain their competitive edge.

Regarding mobile phones, Samsung employs a pricing approach known as price skimming. The pricing is chosen to maximize revenue when significant demand for a new product release exists. After the initial frenzy and excitement dies down, Samsung lowers the price to make the product more accessible to a broader range of customers.

In the beginning, Samsung used price skimming to steal market share and attention from their key competitors. For example, Samsung’s Galaxy phones were priced to grab market share away from Apple’s popular iPhone.

10. High-Low Pricing Strategy Example

When a new product enters the market, it’s common to see high-low pricing applied.

Smartphones are almost always launched at a high price point, then gradually drop as the anticipation subsides. This is true for both flagship and mid-range phones.

Although Apple was the first company to adopt this method of pricing smartphones, it is now used by many manufacturers, including Samsung, Google, Huawei, and others.

When you don’t have any previous sales data on which to base price decisions, using high-low pricing is an effective pricing and marketing strategy. The objective of most retailers is to maximize profits. Therefore, it’s logical to begin your pricing plan with increasing gross profit.

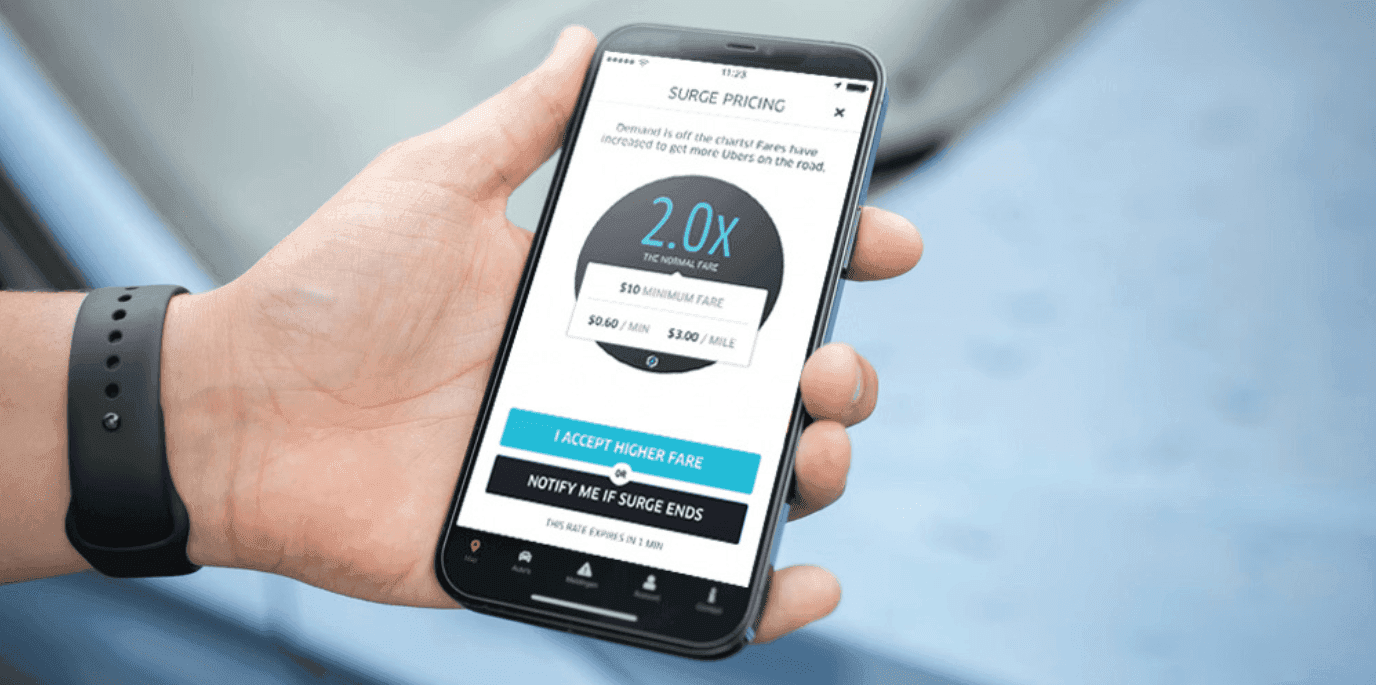

11. Dynamic Pricing Strategy Example

Uber is a significant player in the on-demand transportation industry. Your route’s traffic, peak hours, and current rider-to-driver demand are all factors in Uber’s dynamic pricing algorithm.

Despite the complaints about unfair pricing hikes, Uber stands by its algorithm and maintains that it helps the system manage supply and demand difficulties and provides drivers with incentives to work in challenging situations.

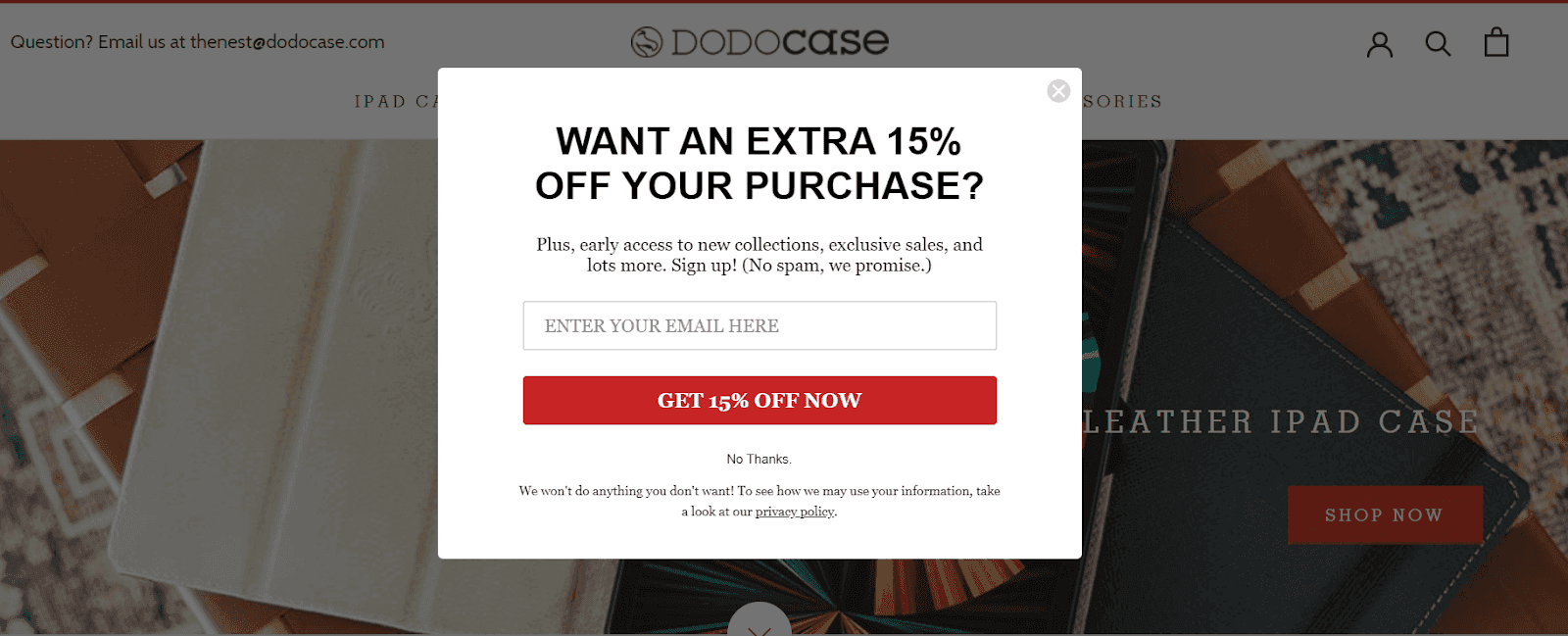

Discounts

“Discount pricing” is a broad term that encompasses a variety of pricing tactics aimed at increasing demand, clearing out unsold inventory, or raising sales. Discount pricing works because customers believe they’re “getting a good deal” on a product or service.

Dodocase provides a one-time discount for new customers’ initial purchases. The offer entices customers to buy once and keep coming back.

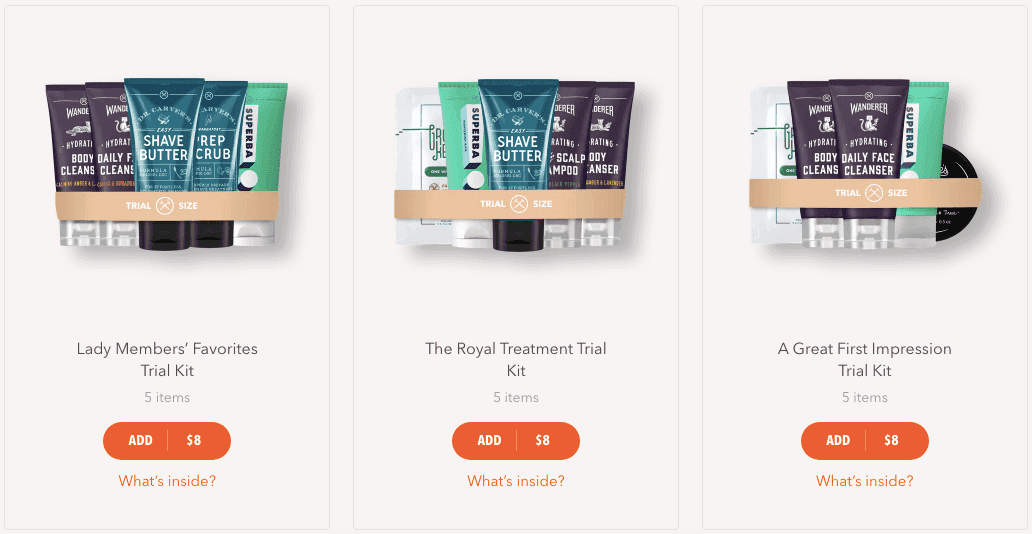

Bundles

Bundle pricing allows small businesses to sell many items at a lesser price than they would if they sold them separately.

Customers believe they’re getting more for their money. When a product’s life cycle is nearing its end, many small businesses opt to use this method, especially if the product isn’t selling well.

Subscription-based merchants like Dollar Shave Club have used this bundle pricing model for their own items.

Psychological

The commercial practice of putting prices lower than a whole number is known as psychological pricing. Buyers would read the slightly lower price and treat it as cheaper than it is. If an item costs $3.99, it is an example of psychological pricing because shoppers see it as a better deal than $4.00.

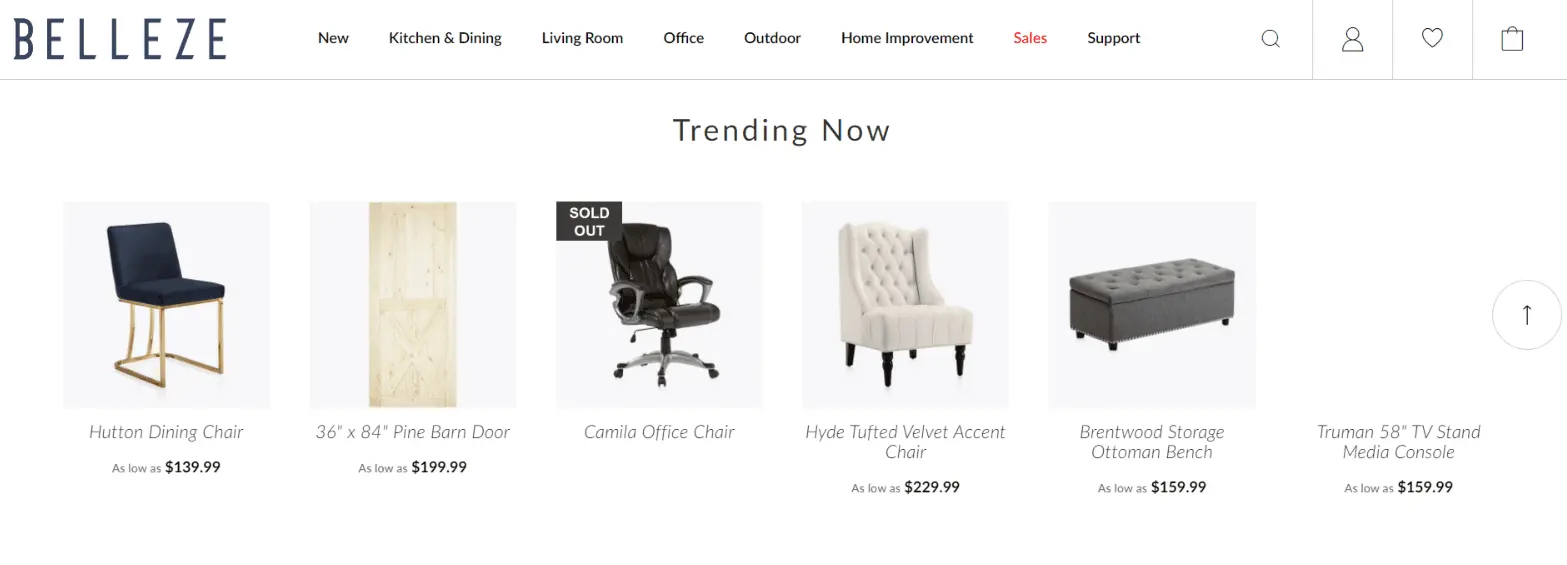

Belleze, a furniture company, adopts this strategy for the product listings across their website: every item is priced so that it ends at .99.

Freemium

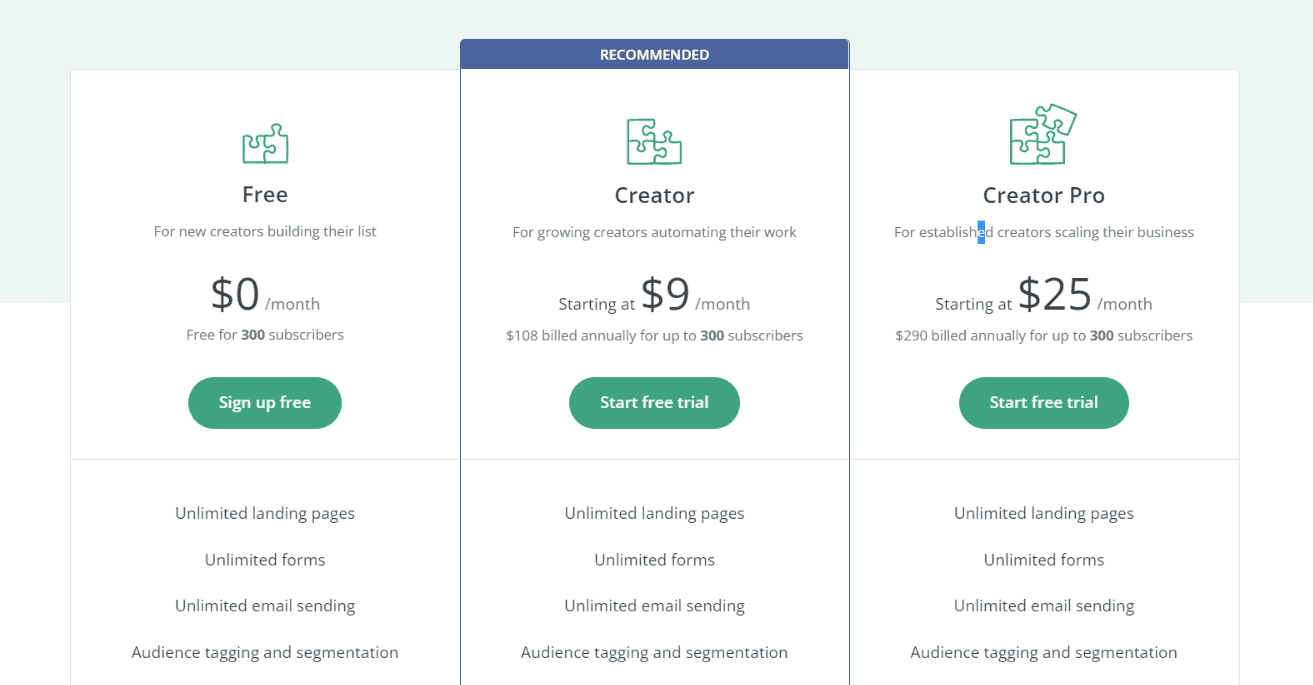

Two phrases are combined in freemium pricing: premium and free. It’s a pricing structure that provides free fundamental services and premium options. By delivering some services for free, this method piques the interest of potential clients. Customers must pay a fee to access the other features.

It only applies to companies that provide limited free trials. MailChimp, for example, offers a free service with a restricted set of options and functionalities. It’s up to the user to decide whether or not they want to pay for the additional features.

But Wait, There’s More

You may have heard this phrases like this at the end of an infomercial. This phrase is effective if you’re offering your customer a gift with purchase or upgrading the size of their purchase for free.

It encourages customers to buy so they don’t miss out on a good deal. It adds urgency to purchases by ensuring customers know they’re getting value for their money. Commercials that offer 2 for the price of 1 or free shipping for a limited time would benefit from using a phrase like this. For example, Granite Rock adds a second frying pan and free shipping if you order right now, adding to the urgency.

BOGO

E-commerce businesses can use a BOGO approach with spending limits to control the average transaction size by incentivizing larger purchases, like upselling. In this strategy, the goods won’t be given away for free just because the customer hit a certain price threshold in their cart. Instead, it lets them choose between a product and a present based on the relative worth of both the thing and the gift they are receiving. Papa John’s does this with their “buy one get one” pizza deal.

Coupons

Companies and stores that provide discounts to their most loyal consumers use coupon marketing as a technique. Customers’ desire to save money is heightened by using coupon codes, vouchers, and other discounting methods.

Coupons that provide a percentage off of a product’s original cost are the most popular. 74% of online buyers prefer “percentage off” coupons, according to a study by Blippr.

Codes

Code Marketing is the “SaaS free trial” applied to a broader range of goods, services, and business sectors. Code Marketing allows customers to “test before they buy,” which fosters customer confidence and reduces hassle throughout the online purchasing process.

Regarding B2B, the SaaS (Software as a Service) segment was among the first to embrace a digital-first strategy. Adapting this method to internet sales was part of the plan all along.

The great thing about this strategy is that consumers become accustomed to their software, so switching might not be cost-effective. Check out this example from Convert Kit.

They are encouraged to stick with it, particularly when you consider that upgrading to the next level only costs $9 per month.

Price Relativity

Price Relativity is the price of a product or service in comparison to another.

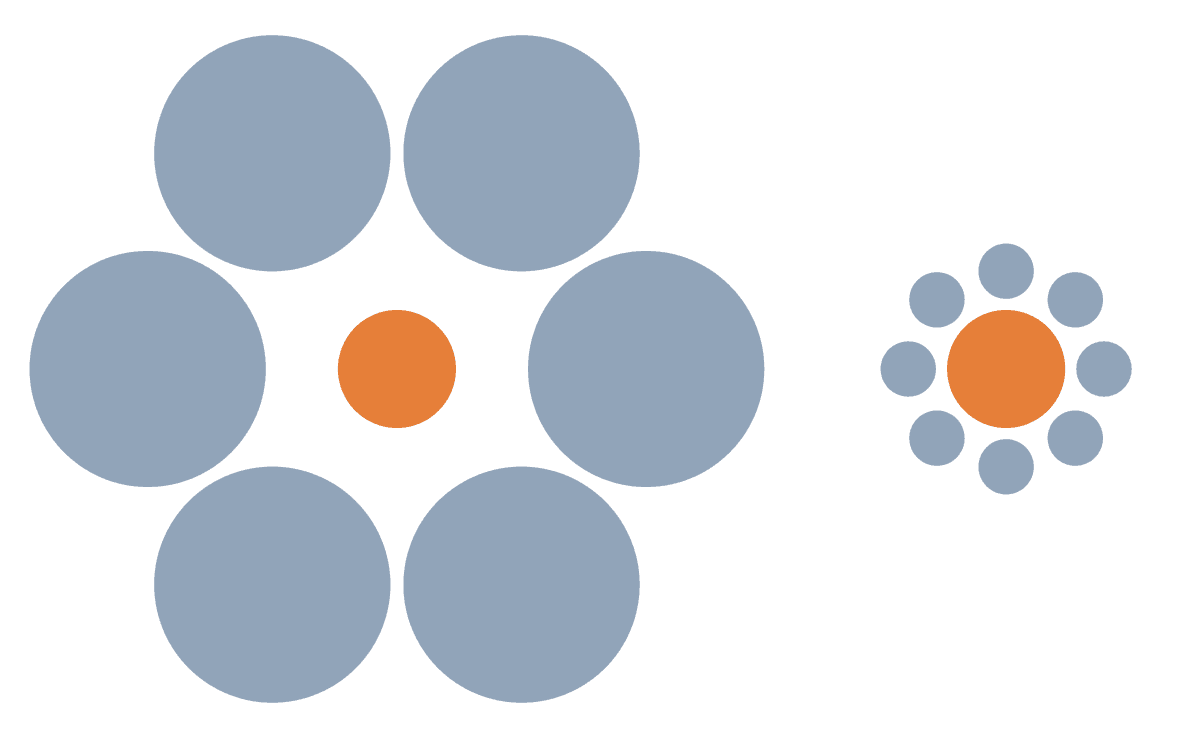

In the image below, which of the orange circles is bigger?

In actuality, both circles are identical in size. Known as the Ebbinghaus illusion, the perceived size of the orange dot is dependent on what it’s compared to.

Price Relativity works in the same way: a comparison is needed to determine the value image of a product.

Take Nespresso, for example. Rather than forefronting the cost of its $200 machine, the company compares a single Nespresso pod to that of a coffee shop.

A medium coffee at Starbucks is $3.95.

A single Nespresso pod costs 35 cents.

By highlighting its surrounding cost, Nespresso changed how a customer perceives the product’s value. Afterall, 35 cents for a cup of coffee, in comparison for $3.95, feels reasonable.

Conclusion

Your pricing strategy is influenced by your company’s financial data and external situations. This includes:

- Knowing the price of your goods or services to help you make better business decisions

- Maintaining a close eye on these expenses to rapidly respond to developments and keep your business profitable in the long run

- Your consumers, the market, and your competitors

- Keeping abreast of changing customer tastes and market conditions, as well as potential supply chain problems

Setting accurate prices for your inventory is one of the most important things you can do to ensure continuing success in your business. It doesn’t matter if you have the best product in the world, the best team, or the most attractive storefront; if you can’t price your products efficiently and don’t have an effective pricing strategy in place, your sales will suffer.